Jio Financial Services Limited (NSE: JIOFIN) has seen a significant drop in its share price over the last six months, falling by approximately 30%. This decline has raised concerns among investors about whether they should hold or sell their shares. In this article, we will analyze Jio Finance’s stock performance, market trends, financials, and expert opinions to help investors make an informed decision.

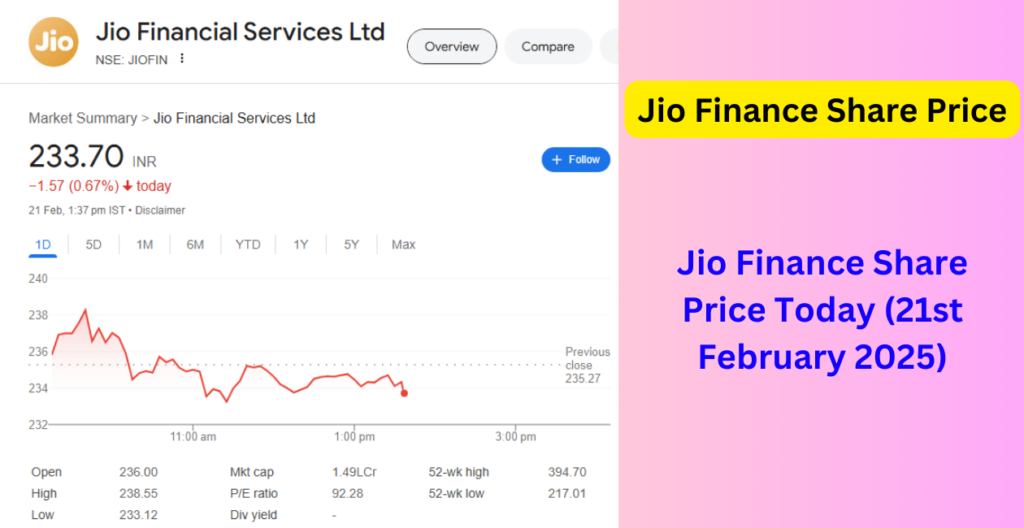

Jio Finance Share Price Today (21st February 2025)

The Indian stock market experienced a mixed trading session on 21st February 2025, with both BSE Sensex and NSE Nifty-50 opening in the red.

- BSE Sensex: Declined by -550.52 points (-0.73%), closing at 75,185.44.

- NSE Nifty-50: Dropped by -170.25 points (-0.75%), closing at 22,742.90.

Sector Performance:

- Nifty Bank Index: -494.00 points (-1.01%) at 48,840.55.

- Nifty IT Index: -254.25 points (-0.63%) at 40,611.70.

- S&P BSE SmallCap Index: -303.71 points (-0.66%) at 45,751.23.

Jio Finance Share Price Movement on 21st February 2025

- Opening Price: Rs. 236

- High Price: Rs. 238.55

- Low Price: Rs. 233.12

- Current Price (12:29 PM): Rs. 234.1 (-0.50%)

- Market Cap: Rs. 1,48,572 Cr

Jio Finance Share 52-Week Range

- 52-Week High: Rs. 394.7

- 52-Week Low: Rs. 217.01

Jio Finance Share Price Performance: Past Returns

| Timeframe | Jio Finance Return | S&P BSE Sensex Return |

|---|---|---|

| YTD (2025) | -21.61% | -3.64% |

| 1-Year Return | -19.29% | +3.68% |

| 3-Year Return | -10.63% | +30.53% |

| 5-Year Return | -10.63% | +82.88% |

Expert Analysis: Should You Hold or Sell Jio Finance Stock?

Current Ratings and Target Price

- Analyst Rating: Hold

- Current Price: Rs. 234.1

- Target Price: Rs. 347

- Potential Upside: 48.23%

Reasons to Hold:

- Growth Potential: Jio Financial Services is expanding its digital finance offerings.

- Part of Reliance Group: Backed by a strong parent company, Jio Finance has a long-term growth outlook.

- Low Valuation: The stock is currently undervalued compared to its previous high.

- Digital Finance Industry Growth: The Indian financial sector is booming with increasing digital transactions.

Reasons to Sell:

- Short-Term Volatility: The stock has been highly volatile, leading to uncertainty.

- Regulatory Risks: Any changes in financial regulations could impact Jio Finance’s operations.

- Market Trends: The overall bearish sentiment in the financial sector may affect stock performance.

Factors Affecting Jio Finance Share Price

1. Company Financial Performance

Jio Finance’s revenue, net profits, and growth strategies will play a crucial role in its stock price movement. Investors should track the company’s quarterly earnings reports.

2. Stock Market Conditions

The overall performance of the Indian stock market influences Jio Finance stock. A bearish trend in Nifty and Sensex often leads to a decline in stock prices.

3. Government Policies and RBI Regulations

Financial services companies are affected by changes in RBI guidelines and government policies. Any new regulation affecting NBFCs could impact Jio Finance’s stock.

4. Reliance Group’s Business Strategies

As Jio Finance is part of Reliance Industries, its performance is linked to the group’s overall strategy. Any announcement from Reliance Industries can drive Jio Finance’s share price up or down.

5. Foreign Institutional Investment (FII) and Domestic Institutional Investment (DII) Trends

FIIs and DIIs play a significant role in determining stock price movements. Any major buying or selling by institutional investors can cause fluctuations.

Technical Analysis: Jio Finance Stock Price Trends

- Resistance Level: Rs. 250

- Support Level: Rs. 225

- Moving Average: Below 50-day and 200-day moving averages, indicating a bearish trend.

- Relative Strength Index (RSI): Near oversold levels, suggesting a possible rebound.

Should You Invest in Jio Finance Stock Now?

- Short-Term Investors: Should wait for a price reversal before entering.

- Long-Term Investors: Can consider holding as the stock has a potential upside of 48% based on analyst target prices.

- Risk-Averse Investors: Should monitor quarterly results and market trends before making a decision.

Conclusion

Jio Finance’s stock has declined by 30% in the last six months, making investors question their holding strategy. While the stock remains volatile, long-term prospects appear positive due to strong backing from Reliance Industries and digital finance growth. However, short-term risks and market fluctuations should be considered before making any investment decisions.